The US Department of Energy (DOE) and other federal agencies consistently provide funding to for-profit commercial sectors.

Before accepting and spending these funds, companies should be aware of the many related grant compliance requirements. Below are some frequently asked questions and a checklist to follow when it comes to grant compliance and federal awards related to DOE grants and contracts.

What Is Grant Compliance and Why Is It Important?

The federal government has long applied compliance requirements to regulate spending of taxpayer funds. These compliance requirements govern everything from the drawing down and spending of funds to the frequency and scope of audits.

Compliance requirements can be significant and differ across federal agencies. While most grantor agencies follow compliance requirements in Uniform Guidance (UG) as included in Title 2 Code of Federal Regulations (CFR) Part 200, the DOE has issued its own additional regulations under 2 CFR Part 910.

Many DOE grants and contracts require you to also comply with the Federal Acquisition Regulations (FAR) 48 CFR Part 31. It’s important to read through these agreements, including notices of award, to understand the differences and which part of either the UG or the FAR apply to your grant, as these could vary based on your funding.

The federal government must view a grant recipient as a good steward of federal dollars. Maintaining compliance with federal government regulations enables companies to not only use federal dollars to fund operations, but also continue to apply for these funds and receive awards in the future.

Noncompliance could result in disciplinary action, which can range from debarment from future federal funding to audits by a federal agency.

Will the Company Need a Pre-Award Audit?

During grant negotiations, some agencies require a pre-award audit prior to the approval of your final award. Your accounting system, written policies and procedures, and internal controls must be ready to accommodate receiving and managing a federal grant. The DOE has an audit checklist available (as does the Department of Defense grant).

The items on these checklists include proper segregation on your chart of accounts related to direct and indirect costs and allowable and unallowable costs, labor distribution reports and the ability to invoice by project.

Being prepared for a pre-award audit is critical. Failing a pre-award audit will cause a delay in the approval of your grant award and may cause other bids and proposals in process to be rejected.

Will Your Company Need to Calculate an Indirect Cost Rate?

Indirect costs are typically a cost component of an approved grant budget. If you have never had a grant award or a government contract, you have probably never calculated an indirect cost rate.

Companies have the option to choose the 10% de minimis rate or propose an indirect cost rate using a methodology acceptable by the cognizant agency, which may be the DOE. It may be beneficial for your company to calculate what your indirect cost rate could be as it could be considerably higher than the 10% de minimis rate. Be aware that some grants do have caps on indirect costs and could limit the amount allowed to be requested.

Will Your Company Need to Be Audited When Accepting a Grant?

Agency audit requirements can differ. However, if your company spends over $750,000 of federal grant funding in a given year from the DOE, your company may need an audit of compliance and internal control over compliance for that year.

These audits are typically due within nine months of the company’s accounting year end. It’ll be your responsibility to engage an auditor. The DOE has posted a compliance matrix on several programs for the auditor to follow. If you haven’t submitted an audit by the deadline, the DOE will be following up with you and expect you to submit the audit, even if after the deadline.

How Can a Company Reduce the Administrative Burden of a Federal Grant?

The administrative burden for a federal grant is typically higher than that of privately funded grant programs. You’ll want to obtain an understanding of your grant compliance requirements. Each DOE grant is different and will require some level of understanding that can be achieved through reading the grant documents, 2 CFR 200, 2 CFR 910, the DOE compliance matrix, and the grantor website.

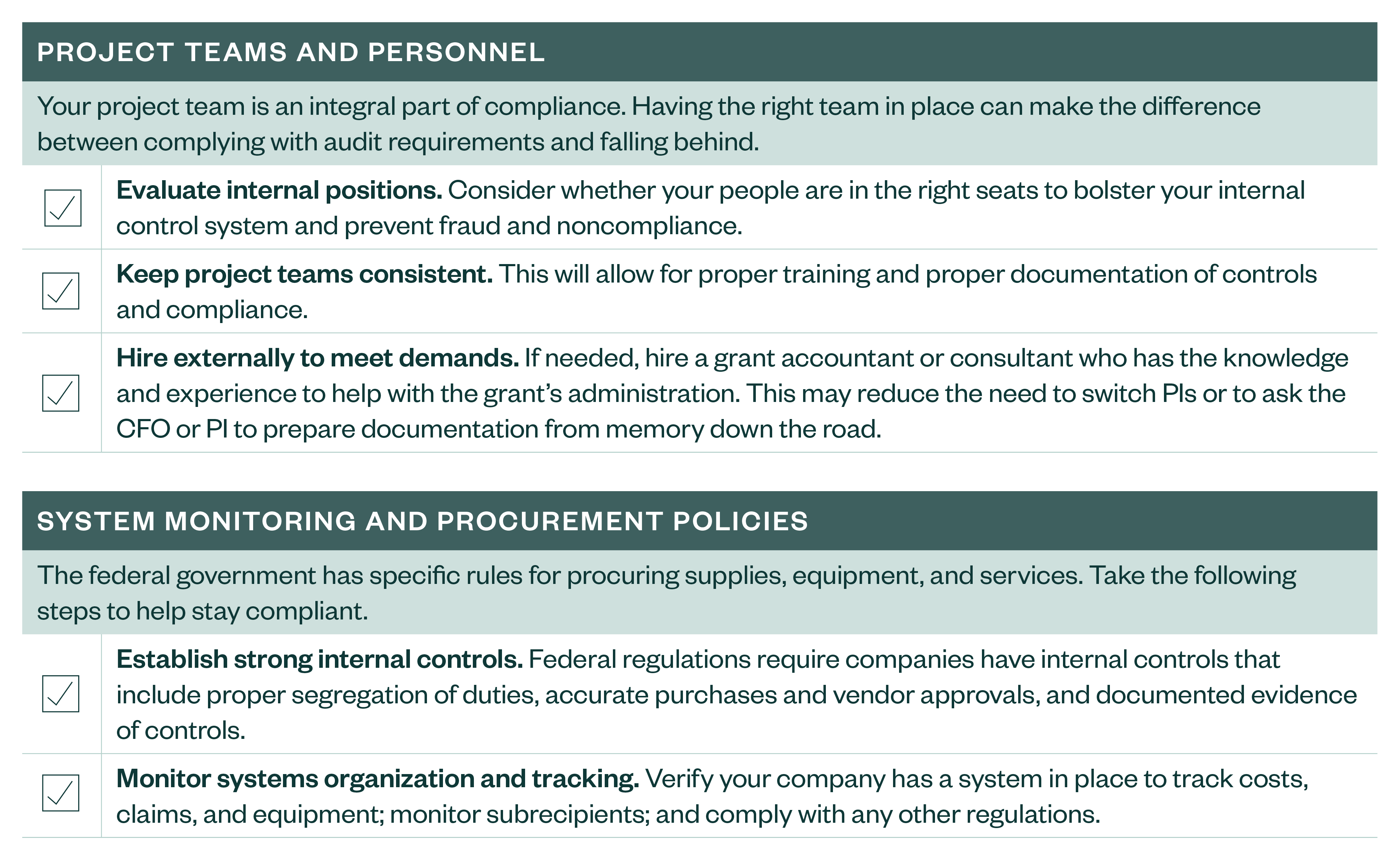

The below federal grant compliance checklist can help your company benefit from the funding it needs without the compliance issues it doesn’t.

Federal Grant Compliance Checklist

We’re Here to Help

If you have any questions regarding Department of Energy grant compliance, please contact your Moss Adams professional. You can also visit our Federal Contract Compliance Services page for additional resources.